Since 2010, international migrant population numbers from Africa have grown significantly. So much so that eight in 10 of the fastest-growing migrant populations are from sub-Saharan African nations, according to a Pew Research Center analysis of the latest United Nations data on the number of emigrants, or people living outside their country of birth.

Much of the conversation about migration, particularly when it comes to Africans, is dominated by the terrible scenes we see reported from Libya and deadly Mediterranean crossings. The narrative is still largely the same—people are seeking a better life in new surroundings.

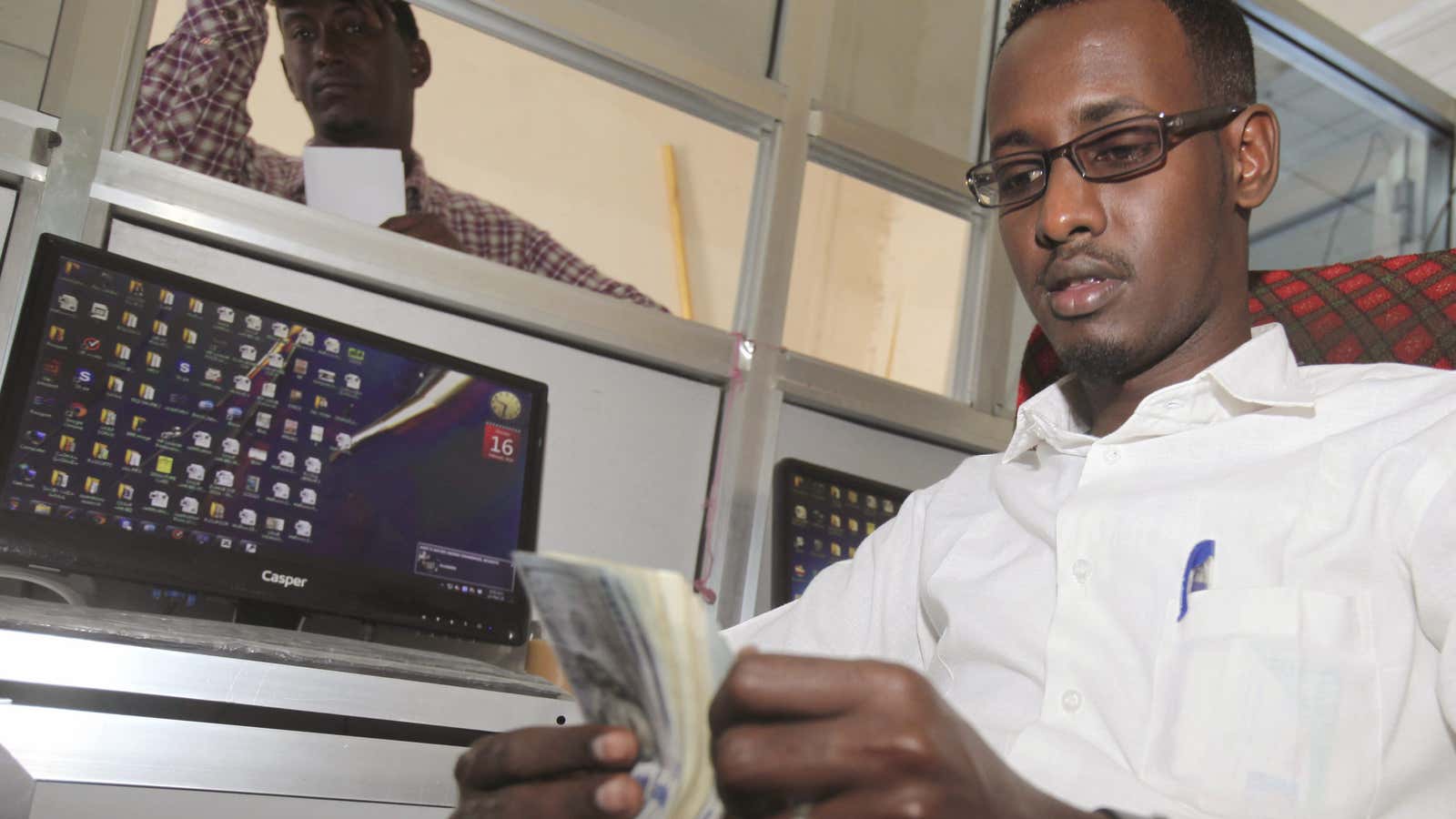

From an economic point of view, the rapid growth in the numbers from Africa is of great interest. This is especially true for the money transfer industry. Remittances to sub-Saharan Africa grew to $37.8 billion in 2017, according to the World Bank and are forecast to hit around $39.2 billion this year and $39.6 billion in 2019. Perhaps unsurprisingly, as the largest population and economy, Nigeria topped African recipients with $22.3 billion in 2017. Liberia was the African country for whom remittances accounted for the highest share of GDP at 25.9%.

Even as those numbers grow, it’s clear the nature of migration and the migrant experience is changing. Technology is making this even more true. Ismail Ahmed, founder of WorldRemit, a London-based remittances business, is very clear about the impact of innovation on his business. WorldRemit, which opened an office in New York this week, has operations in 50 countries around the world and completes nearly a million transactions a month. It took around £60 million (~$80 million) in revenue last year and has a current annualized run rate of around $100 million.

Ahmed, who is originally from Somaliland, says innovation has played a crucial role in changing the way companies like his are able to connect migrants in Western countries to their homes in Africa, Asia or Latin America for example. Needless to say, the mobile phone has been vital in enabling the ease of connection, more migrants send smaller amounts more frequently now, with apps, mobile money and traditional bank accounts all playing their role.

But while much focus is often on migrants in Western countries, the largest amount of people moving to new countries is within Africa. One of the biggest challenges that face those who have moved to African countries is the lack of infrastructure that makes it easy for them and citizens to move money between neighboring countries. Indeed, Africa has the highest remittances costs in the world. The World Bank typically measures the cost of sending $200 and in the third quarter it was $9.10, compared to the global average of $7.20.

Ahmed sees this as an important opportunity for his company to fix a multi-billion dollar money transfer problem between neighboring African countries. This wouldn’t just have a significant impact on the hundreds of thousands of Africans moving between countries in search of a decent living, but also even those traveling on short business trips. Not only does technology add a convenience to the process but in Africa it brings a layer of transparency to things like exchange rates which should have significant impact and encourage more economically beneficial movement between countries.